Disclaimer: Try out Root and get $25 if you get a quote. I get $25 as well so please support my blog. There are no hidden fees and this is not an MLM. I only support or promote products that I actually believe in, use, and think will help those around me.

If you are like me, you may have recently had a life changing event, such as a job loss, underemployment, a new child, big emergency expense, or unforeseen tax obligations. If you are budget conscious, saving money where you can makes sense. An extra $10 to $100 a month can mean the difference between having blow money to stay sane, new clothing for that friends wedding, or a night out with the family.

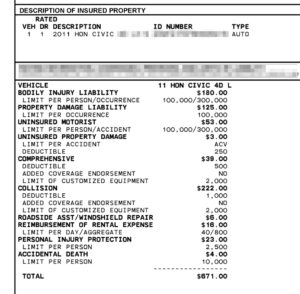

This is why every time I get a letter that says my insurance is going up, I cringe a little.

I love my current company. It is a smaller player that gave us way better rates than the Lizard company did a few years back. I haven’t gone through an agent yet, but in the few times I have tried to get different rates online, they don’t seem to be any lower, or negligibly so. My current company does have a loyalty program that would give us about $350 a year back starting in November. So whoever I did switch to needed to be at least $30 cheaper a month for it to make sense. That is why I chose Root.

In this article I am going to go over the following:

- What Root Insurance is

- If it is Legit/For Reals – Can you save 50% or more

- How you can get $25 for free (no obligation)

- Explain the 5 reasons why I am switching over

- Answer some of the Biggest Concerns you might have

- Show a side-by-side comparison of my old and new insurance

- Who is Root Insurance going to help the most?

Who and what is Root Auto Insurance?

Root is a new startup company that is disrupting the car insurance sector, much like Uber and AirBNB has disrupted the taxi and hotel industries. Root’s premise is that you can save up to 50% or more on car insurance because they base your rates primarily on how you drive (by using an app to track you – if this bothers you please see the concerns section) as well as not providing insurance to bad drivers. They offer a referral program that lets each person get $25 if you qualify for a quote. It is not an MLM, but rather a lean and small startup that takes out the middle men (insurance salesman) and puts the power of coverage and lower rates straight into your hands.

Root is Currently available in: Montana, Utah, Arizona, New Mexico, Texas, Oklahoma, Louisiana, Mississippi, Illinois, Indiana, Ohio, Kentucky, and Pennsylvania. I will update this list as they expand.

Is Root Car Insurance Legit? Can you really save 50% a month?

Yes. It is legit. Root has backing from the reinsurance companies Munich RE ($59 Billion in Revenue 2016), Maiden RE, and Oddesey RE. Root claims that the three companies have over $250 Billion Dollars in holdings.

Ok. That is all fine and good, but do they actually pay out? Yes they do.

A friend of mine had to have an SR-22, for good driving he was able to increase his coverage and save $500 per 6 months or about 65% off!

Tyler is saving 70% (not me, another person who has a strong and attractive name).

Coultin is saving about 70% as well!

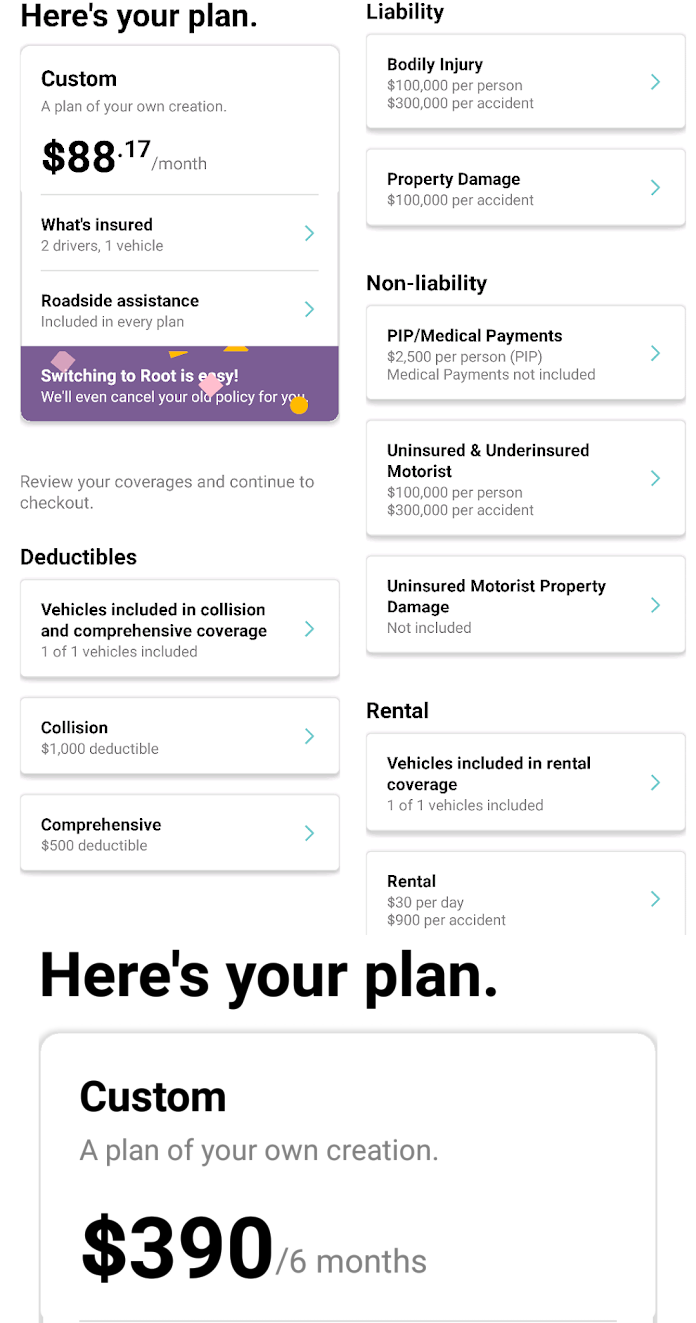

In fact, I will be saving around $25/month when I pay monthly (~22% savings) and ~$47 a month when I pay for 6 months (~41% savings). Read on to see the comparison chart on coverage.

Some people have stated that the quotes that they got through ROOT is higher. I suspect that they did not check the 6 month discount amounts, but a majority of the review that I have seen state that they saved money.

I’m Sold, I want to Get a Quote and $25 for free

You have come to the right place. If at any time you decide you want to sign up and want to get the $25 for free, please make sure to use this link.

Remember that if you sign up, and it doesn’t look similar to this picture, neither you, nor myself, will get the free money for a date night, tacos, or another important yet life altering event. My wife really wants that date, so help a brother out.

5 reasons why I am switching over

1. Saving $564/Year Over the Cheapest Company

Currently I pay around $112 per month, including a rental home insurance discount, for my car insurance. This is for 2 people driving a single vehicle.

Once I start paying up front for a 6 month policy, I will be saving $564/yr over my current plan. If you include the money that i would have gotten with my loyalty discount, that is still around $200. I might shop around a bit more to update this section, but I believe that I am saving $564 over the cheapest company that I can get insured with (that I actually want to do business with). Others have found Root to be much cheaper than the cheapest alternative as well.

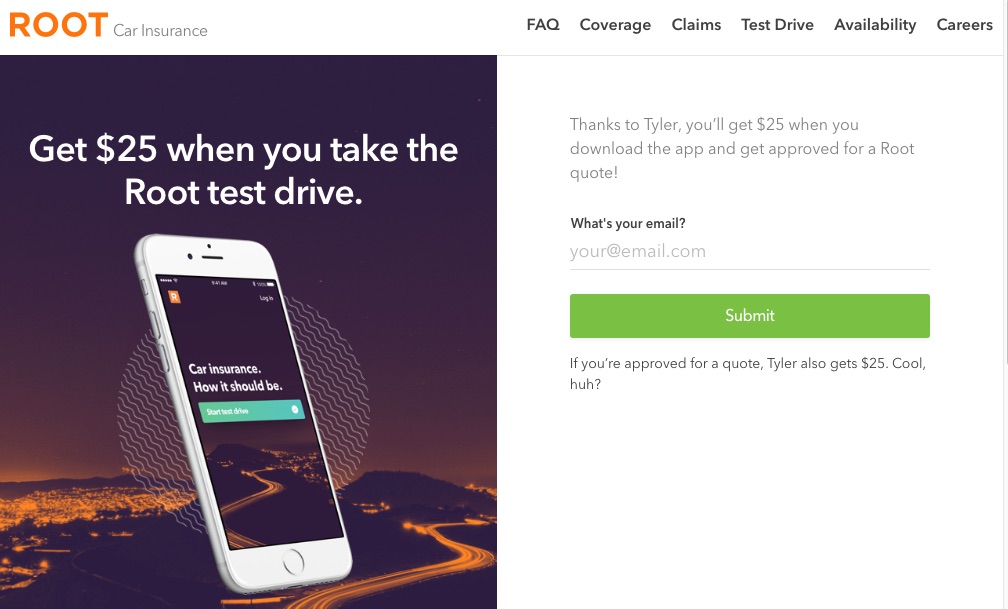

2. Maintaining Similar Coverage Amounts

While I don’t have the exact same coverage as before, it is nearly identical and my savings align with the risk that I am willing to take to not have that coverage. Others have been able to increase their coverage while still being able to lower there bills.

2. Free $25 for a Test Drive

I may have tried out Root anyways, but getting a check for $25 just to get a quote really helped me get to the point of switching over.

4. Less Headache

I don’t want to have to go through my agent each time I move, need to change my coverage, or have to change my agent if I move states

5. Change your coverage on the Fly

It is nice to be able to change your coverage when ever you want and to be able to decide and instantly see the quotes for your coverage. Being able to look at each option I have, as well as a little Google-Fu, has helped me to understand where I might want to increase or decrease coverage in the future.

I am sure you can do this with some insurance providers, but mine currently doesn’t have this option.

But I am worried about…

I found out about Root insurance via an acquaintance that was using it. I’m sure when I found out about it I was super excited to learn more. More recently, I remember pouring over the FAQs page and trying to understand what program worked and if it was indeed legitimate. My friend even brought up a few of these concerns and I decided to address them. I even stumbled across this reddit article at some point. While Root’s FAQ page addresses even more of these concerns, here are some of the most important ones that I have come across or have been concerned with:

- Won’t they just sell my data?

- Do I need to be tracked constantly by the application?

- Am I a good enough driver to even get a discount?

- Does the coverage match my current insurance?

- Is Root going to pay out on Claims? How fast will it be? How hard it is to file a claim?

I am going to address each of these concerns one at a time, and by the end, I hope to show you that getting $25 free and save up to 50% or more on your car insurance is real and worth it.

Won’t they just sell my data?

Root claims that they will not sell your data. You will need to pour over there Privacy policy to make sure they won’t share it in any other way. If anyone has more information on this please post a comment below.

Do I need to be tracked constantly by the application?

While you do have to have the app installed, your GPS on, and the correct permissions enabled for the test drive, you don’t need the app to be installed once the test drive is complete. I recently asked support about uninstalling the app after purchase and got the following response.

“The reason we recommend that all of our users keep the app on their phones is because of what the app allows you to do. The post-purchase app allows you to access and print your policy documents, edit your coverages, add/remove drivers and vehicles, contact support, update billing method, and even file claims. However, not having the app on your phone after purchase will not affect your eligibility or pricing.”

Apparently, Google has been tracking you even if you have locations off. If you are truly concerned about Privacy, I would really not own a phone.

Another hack is to turn off the permissions that the app has to locations or any other permissions that you are worried about. I am not 100% certain this won’t affect your policy but based on the previous response I don’t see why it would.

Am I a good enough driver to even get a discount?

I drove much more carefully than I normally drive during my day to day driving. It was better during the first week or two of driving. In total, I think it took about 3-4 weeks to finally get a quote, so just know that the process will take longer if you drive less miles, but if you drive more miles, that could also affect your rates, so only drive more if you are trying to finish up your quote 2 to 3 weeks in.

A word of Caution: I have seen a few reports on Root’s Facebook Reviews about tracking happening when they are the passenger in a friends vehicle. One person ended up not getting a quote because of bad driving that a friend was doing. I feel like the same happened to me when my wife was driving with me and on other occasions. I think this will keep improving but I don’t think that their detection technology for knowing who is at the wheel is 100% accurate yet.

Does the coverage match my current insurance?

Keep reading and you will see my side-by-side coverage chart and explanation. To know exactly how you are covered you may need the help of legal counsel and/or pour over your contract with Root and your old company.

Is Root going to pay out on Claims?

Yes. They will. Checking out different reviews online shows that they will pay out on claims. See Anna’s Testimonial, Logan’s Testimonial, or Jason’s Testimonial

Root says that they pay claims “Usually 7-10 business days, which is significantly faster than the industry standard.”

It is also super fast and easy to file a claim.

My Old Insurance Policy vs. ROOT Insurance.

Here are legitimate screenshots of my old and new policies. It is apparent who the winner is.

Coverage and Premium Comparison Chart

| Coverage Item | Old Ins. | Root Ins. |

|---|---|---|

| Collision Deductible | $1000 | $1000 |

| Comprehensive Deductible | $500 | $500 |

| Liability – Bodily Injury Per Person | $100k | $100k |

| Liability – Bodily Injury Per Accident | $300k | $300k |

| Liability – Property Damage Per Accident | $100k | $100k |

| Personal Injury Protection Per Person | $2,500 | $2,500 |

| Accidental Death Per Person1 | $10,000 | None |

| Un/Underinsured Motorist Bodily Injury Per Person | $100k | $100k |

| Un/Underinsured Motorist Bodily Injury Per Accident | $300k | $300k |

| Uninsured Motorist Property Damage Coverage 2 | AVF | None |

| Uninsured Motorist Property Damage Deductible2 | $250 | N/A |

| Rental – Per Day3 | $40 | $30 |

| Rental – Per Accident3 | $800 | $900 |

| Roadside Assistance4 | Unlimited? | Up to $300 |

| Windshield Repair5 | Included | Included |

- I am currently inquiring with Root about the possibility of adding Accidental Death to my coverage. While it is a bit of a risk not to have it, I am not too worried about not including it in my premiums right now. With Root, as far as I know, this isn’t even an option to add. It also only costs $4 per a 6 month term. Please leave a comment below if you think that not having this coverage is a larger risk than I think it is or if you know more about it!

- Uninsured Motorist Property Damage is technically covered when you get comprehensive coverage. In my case, my old company makes me pay $3 and lowers my deductible to $250 instead of $500. The problem is that it only covers the Actual Cash Value of my vehicle. With Root, I can increase my premium by $4 monthly to get covered up to $25,000 on the property value. It also does not mention a deductible which means I think it is $0. Because of this, I opted out of having this coverage and consider the difference to be negligible.

- You can tell that Root pays out $10/day less than my old insurance, the difference here is that my old insurance would reimburse me for this cost while I believe Root covers it. Even if Root doesn’t cover the Rental cost up front, it does give you up to $30/day in Lyft credits. In my opinion, the difference between my new and old coverage in regards to Rental is kind of a toss up.

- I need to do a bit more research but I think that my old insurance had unlimited roadside assistance and reached out to a tow truck company on my behalf. Root only reimburses you for up to $100 for each incident (up to 3 incidents in 6 months). This may be a dealbreaker if you have an unreliable vehicle or if you lose your keys a lot, but it wasn’t for me.

- This is only covered on Root if you have Comprehensive coverage. Does anyone know if making a claim affects your insurance rates if you have Root or if you are using another company? Please comment Below!

Who is Root Insurance Going to Help the Most?

From reviews I have read and this Root article, the following are those who will benefit the most from Root Insurance

- People with a few Wrecks who are actually good Drivers

- Those with Poor Credit that are safe drivers

- Teenagers who are safe drivers

- If you have had an SR-22 and are a good driver

- If you have really high insurance and are a good driver

- If you want minimum coverage and have higher insurance than you should, but are a safe driver

Time to Get $25 for Free

Seriously, you have nothing to lose by trying out Root. Get Your Quote Today! Get your $25 check in 2-3 weeks doing nothing but your day to day travel. The process is painless and you have nothing to lose. I already got my check!

I hope you have enjoyed this article. Please let me know if you would like me to make a video in the comments below and I will do so.